Workers Compensation in CT

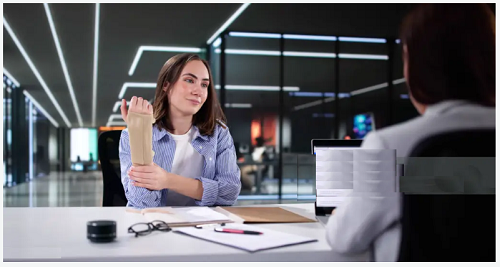

Protecting Your Employees and Business: Workers’ Compensation Insurance in Connecticut

Whether you’re running a small shop, managing a busy restaurant, or overseeing a construction crew, your employees keep your business moving every day. But are you confident they’re fully protected if an accident happens at work? The cheapest Workers’ Compensation policy isn’t always the best one, especially when an employee’s health and your business’s future are at stake.

At Page Insurance, we provide clear, comprehensive, and affordable Workers’ Compensation coverage. We’ll help you find the right policy so you can protect your employees and keep your Connecticut business running with total peace of mind.

Connecticut Employers with Staff

If you operate a business in Connecticut and have one or more employees, state law requires you to carry workers’ compensation insurance. This applies whether your staff is full-time, part-time, or seasonal. Compliance isn’t optional—it’s essential for legal protection.

Business Owners Across All Industries

From construction and landscaping to retail and professional services, every business that involves physical work or customer interaction faces risk. Workers’ compensation is vital for industries where injuries are more common, but even office-based businesses can experience accidents like slips or strains.

Independent Contractors and Growing Teams

Even if you work with freelancers or are just starting to hire, workers’ comp coverage protects both your workers and your business. It shows responsibility, builds trust, and helps avoid costly legal issues from unexpected workplace injuries.

Why Choose Page Insurance for Your Workers’ Compensation Policy?

Local Expertise, Personalized Support

At Page Insurance, we understand the unique needs of Connecticut business owners. With in-depth knowledge of local workers’ comp laws and industry-specific risks, we tailor coverage to ensure compliance without unnecessary costs. You’re not getting a generic policy—you’re getting protection built for your business.

Access to Top-Rated Carriers

We partner with multiple top-rated insurance providers, allowing us to compare rates and coverage options that fit your budget and workforce. Whether you have one employee or fifty, we help you find the right balance between affordability and protection.

Ongoing Guidance and Claims Support

Our service doesn’t end when the policy is issued. From updating your coverage as your business grows to assisting with claims, we’re with you every step of the way. Page Insurance is your long-term partner in workplace protection.

What Does Our Workers’ Compensation Insurance Cover?

Medical Expenses and Recovery Support

Workers’ compensation insurance helps cover the cost of medical treatment when an employee is injured or becomes ill due to a work-related incident. This includes doctor visits, emergency care, hospital stays, surgeries, physical therapy, and rehabilitation services. It ensures your team receives the care they need to heal properly.

Lost Wages and Disability Coverage

If an injured employee is unable to work, the policy provides a portion of their lost wages while they recover. It also includes coverage for temporary or permanent disability, helping them maintain financial stability during a difficult time. This allows employees to focus on healing without added stress.

Legal Protection for Employers

Workers’ compensation also protects your business. It covers legal fees, settlements, or judgments if an employee files a lawsuit related to a workplace injury. This provides peace of mind and safeguards your company’s finances and reputation.

How Much Workers’ Compensation Insurance Do I Really Need?

The amount you need depends on your payroll size, number of employees, and industry risk. Connecticut law requires coverage for most businesses with staff, but the right policy should also match your workplace hazards. Page Insurance helps assess your unique needs, ensuring you meet legal requirements while protecting your business from unexpected medical costs, lost wages, and liability claims.

How Can I Lower My Workers’ Compensation Insurance Premium?

You can lower your workers’ compensation premium by maintaining a safe workplace, reducing claim history, and accurately classifying your employees by job type. Implementing formal safety training programs and return-to-work policies can also reduce risk and costs. Regularly reviewing your policy with a local expert like Page Insurance ensures you’re not overpaying and that your coverage matches your business needs. We help you find competitive rates without sacrificing protection.

Does My Workers’ Compensation Policy Cover Temporary or Contract Workers?

In most cases, standard workers’ compensation policies are designed to cover your direct employees, not independent contractors or temporary workers unless specifically added. However, depending on how your workforce is classified and structured, you may still be held liable for certain injuries. It’s important to clearly define your team and work with a knowledgeable insurance advisor like Page Insurance to ensure the right individuals are protected under your policy.

Get the Right Coverage for the Work Ahead

Don’t settle for a one-size-fits-all policy. Let our Connecticut experts tailor a workers’ compensation plan that fits your business, your employees, and your budget.