Landlord Insurance in Connecticut: A Complete Guide for Rental Property Owners

Owning a rental property can be a smart investment—but it also comes with risks that standard homeowners insurance doesn’t fully address. From property damage to tenant liability claims, landlords face unique exposures that require specialized protection.

That’s where landlord insurance comes in.

In this guide, we’ll explain what landlord insurance is, what it covers, what it may not cover, how much it costs, and how Connecticut property owners can choose the right policy.

Table of Contents

- What Is Landlord Insurance?

- Who This Guide Is For

- Why Landlord Insurance Is Important for Property Owners

- What Does Landlord Insurance Cover?

- What Landlord Insurance Does NOT Cover

- Connecticut Considerations for Landlords

- How Much Does Landlord Insurance Cost in Connecticut?

- Landlord Insurance vs. Homeowners Insurance

- Tips for Choosing the Right Landlord Insurance Policy

- Frequently Asked Questions About Landlord Insurance

- Protect Your Rental Property with Landlord Insurance

What Is Landlord Insurance?

Landlord insurance is a type of insurance policy designed specifically for property owners who rent out homes, apartments, or multi-family buildings. Unlike homeowners insurance—which is intended for owner-occupied properties—landlord insurance is built for tenant-occupied rentals.

If you rent out a home, condo, or apartment in Connecticut, landlord insurance helps protect:

- The physical structure of your rental property

- Your liability as a property owner

- Your rental income if the property becomes uninhabitable due to a covered loss

If you currently insure a rental with a homeowners policy, it’s important to review your coverage. You may also want to explore

Homeowners Insurance in Connecticut

to understand how the two policies differ.

Who This Guide Is For

This guide is especially helpful if you are:

- A first-time landlord renting out a former primary home

- An owner of a condo, duplex, or multi-family rental

- An investor relying on rental income to help cover mortgage or expenses

- Considering switching from homeowners insurance to a landlord policy

Why Landlord Insurance Is Important for Property Owners

Renting property exposes you to additional risks—many of which are not covered by standard home insurance policies.

Common Risks Landlords Face

- Fire, wind, or storm damage

- Tenant or guest injuries on the property

- Lawsuits related to unsafe conditions

- Loss of rental income after a covered loss

Without landlord insurance, these situations could lead to significant out-of-pocket expenses. If you own multiple properties or rely on rental income, landlord insurance can provide meaningful peace of mind and financial stability.

What Does Landlord Insurance Cover?

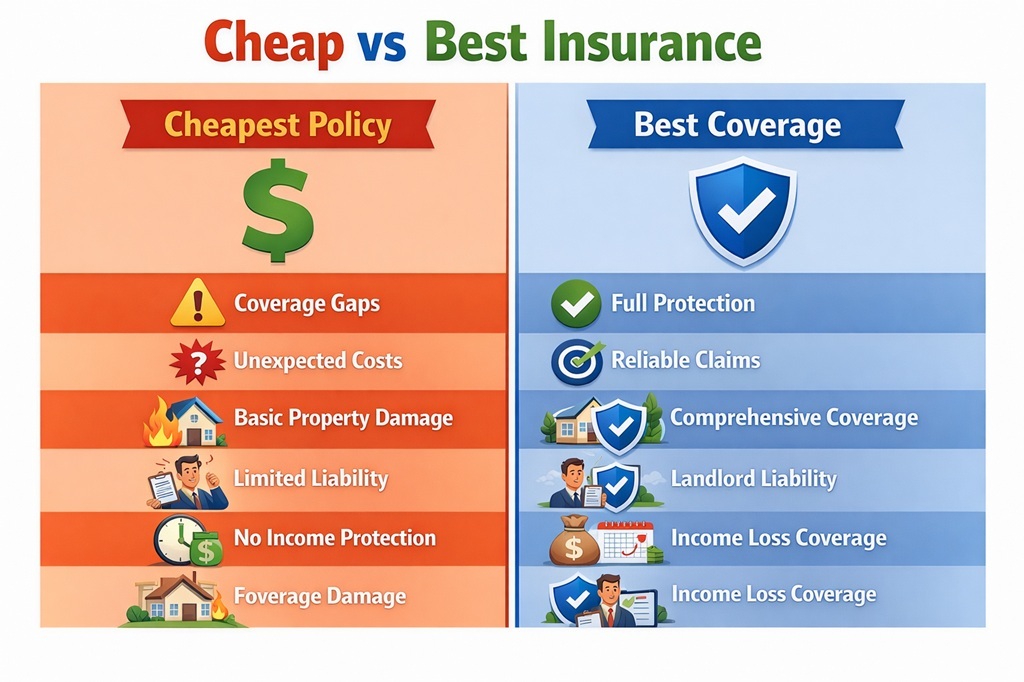

Cheapest landlord insurance may lower premiums upfront, but comprehensive coverage offers better protection, predictable claims, and long-term peace of mind.

Landlord insurance policies typically include several core coverages designed to protect rental property owners.

Property Damage Coverage

This coverage helps pay for repairs or rebuilding if your rental property is damaged by covered events such as fire, storms, or vandalism. It generally covers the structure of the building and may include detached structures like garages or sheds.

If your rental property is temporarily vacant, you may also want to review

Vacant Dwelling Insurance

for added protection.

Landlord Liability Insurance

Landlord liability insurance protects you if a tenant or visitor is injured on your property and you are found legally responsible.

This coverage can help pay for:

- Medical expenses

- Legal defense costs

- Settlements or court judgments

For landlords with higher exposure, additional protection may be available through

Personal Umbrella Insurance.

Loss of Rental Income Coverage

If your rental property becomes uninhabitable due to a covered loss, this coverage helps replace lost rental income while repairs are being completed.

This is especially important for landlords who depend on rental income to cover mortgage payments or operating expenses.

What Landlord Insurance Does NOT Cover

While landlord insurance offers broad protection, it does not cover everything. Common exclusions include:

- Tenant personal belongings (covered by renters insurance)

- Normal wear and tear

- Intentional damage caused by the landlord

- Certain natural disasters without endorsements (such as floods)

For properties in flood-prone areas, you may need separate

Flood Insurance.

Connecticut Considerations for Landlords

Connecticut landlords face unique insurance risks—from winter weather and coastal storms to tenant liability and rental income disruption—that make comprehensive coverage essential.

Connecticut properties can have risk factors that influence coverage decisions and pricing, such as coastal exposure, winter weather, and older housing stock. If your rental is near the shoreline or in a flood zone, talk with your agent about endorsements or separate policies that help address those risks.

If you’re unsure what coverage fits your property, it may help to start with a simple review and quote request.

How Much Does Landlord Insurance Cost in Connecticut?

The cost of landlord insurance varies depending on several factors, including:

- Property location and construction

- Age and condition of the building

- Coverage limits and deductibles

- Number of rental units

- Claims history

Landlord insurance typically costs more than homeowners insurance due to the increased risk associated with tenant-occupied properties. However, the added protection often outweighs the additional cost.

Landlord Insurance vs. Homeowners Insurance

Many property owners assume homeowners insurance is sufficient—but that’s a common and costly mistake.

| Coverage Type | Homeowners Insurance | Landlord Insurance |

|---|---|---|

| Owner-occupied home | ✔️ | ❌ |

| Rental property | ❌ | ✔️ |

| Liability for tenants | Limited | ✔️ |

| Loss of rental income | ❌ | ✔️ |

If you rent out your property—even part-time—landlord insurance is the appropriate coverage.

Tips for Choosing the Right Landlord Insurance Policy

Before selecting a policy, consider the following tips:

- Review liability limits carefully

- Ask about loss-of-income protection

- Understand exclusions and deductibles

- Consider umbrella coverage for added protection

- Work with a local insurance agency that understands Connecticut property risks

At Page Insurance, our team works with landlords across Connecticut to tailor coverage to their specific needs.

Frequently Asked Questions About Landlord Insurance

Is landlord insurance required in Connecticut?

Landlord insurance is not legally required, but many mortgage lenders require it for rental properties.

What does landlord insurance typically cover?

Most landlord policies include property damage coverage for the structure, liability coverage, and loss of rental income coverage (if the property becomes uninhabitable due to a covered loss). Optional add-ons may be available depending on the property and carrier.

Does landlord insurance cover tenant damage?

Accidental tenant damage may be covered depending on the cause and policy terms, but intentional damage is typically excluded. Reviewing exclusions and endorsements is important.

How much landlord insurance do I need?

Coverage needs depend on the replacement cost of the property, your liability exposure, and your rental income. Many landlords choose higher liability limits and consider umbrella coverage for additional protection.

Is landlord insurance tax deductible?

In many cases, landlord insurance premiums may be considered an operating expense for a rental property. For tax questions specific to your situation, it’s best to confirm with a qualified tax professional.

Do tenants still need renters insurance?

Yes. Renters insurance protects tenant belongings and their liability, while landlord insurance protects the property owner and the building.

You can learn more by reviewing

Renters Insurance

coverage options.

Protect Your Rental Property with Landlord Insurance

Landlord insurance is an essential safeguard for rental property owners in Connecticut. From property damage and liability protection to loss of rental income, the right policy helps protect your investment and your peace of mind.

If you own a rental property and want to review your coverage options, our team is here to help.

Request a quote today through our

Landlord Insurance Form

or Contact Page Insurance to speak with a local insurance professional.